Breaking into the financial services sector feels like cracking a vault. Decision-makers are guarded, sales cycles are long, and one misstep costs you the entire relationship. But here’s the truth: you’re not locked out. You just need the right key: a strategic, compliant banking and finance email list that connects you directly with CFOs, risk managers, and IT directors who hold the budget strings.

What Is a Banking and Finance Email List?

A banking and finance email list is a curated database of verified contacts from financial institutions, banks, credit unions, investment firms, fintech companies, and insurance providers. Unlike generic B2B lists, a finance and banking industry email list is precision-engineered for marketers who understand that reaching a Chief Risk Officer requires a completely different approach from typical B2B outreach.

Key Data Fields

A quality finance banking email list includes:

- Business email addresses (verified, not personal)

- Job titles and departments

- Company name, size, and asset range

- Industry segment (banking, fintech, insurance)

- Geographic location

- Decision-making authority level

- Technology stack information

- Direct phone numbers

Why Banking Email Lists Drive High-Value B2B Results

Access to High-Intent Decision Makers

Financial services professionals aren’t browsing LinkedIn hoping someone pitches them. But CFOs, Compliance Officers, and IT Directors are actively seeking solutions to expensive problems. When you use a banking and finance email list, you’re potentially solving their day, not interrupting it.

The numbers tell the story: average banking software contracts range from $50,000 to $500,000+ annually, with client retention exceeding 85%. Compare that to traditional B2B SaaS, averaging $15,000-$30,000 with higher churn.

Precision Targeting Beats Spray-and-Pray

A banking industry mailing list and email list lets you segment by institution type, asset size, and functional role. Target only commercial banks with over $1 billion in assets. Focus exclusively on Series B fintechs. Reach compliance officers at Midwest credit unions. This isn’t just efficient, it’s respectful.

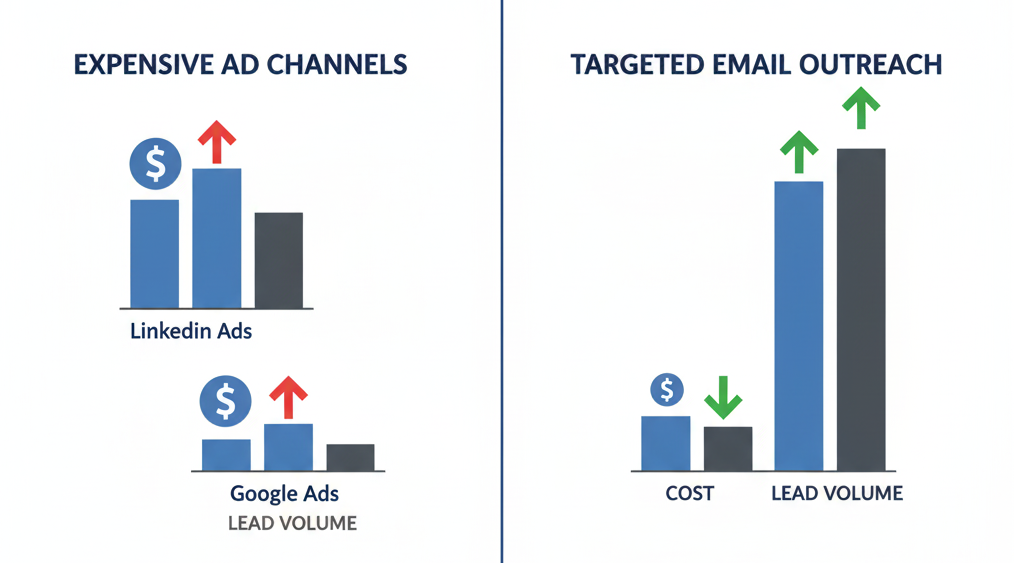

ROI That Actually Makes Sense

LinkedIn ads targeting financial executives can cost $50-100 per click. Google Ads? $15-50 per click before anyone considers your offer. A verified List of USA Banking & Finance Companies costs once, then works across multiple campaigns. One cybersecurity company compared: $25,000 on LinkedIn ads generated 47 leads ($531 CAC) versus $5,000 on a targeted email list generating 89 qualified leads ($56 CAC).

Top Use Cases for Banking Email Lists

B2B Products That Win:

- Fintech and SaaS platforms (core banking, payments, lending)

- Compliance and risk management tools (AML, KYC, audit systems)

- Cybersecurity solutions (fraud detection, endpoint protection)

- Data analytics and AI services (predictive models, BI dashboards)

- Consulting and outsourcing services

- Customer experience and CRM tools

Campaign Types That Convert:

- Personalized cold email sequences (5-15% reply rates when done right)

- Account-based marketing for the top 50 target accounts

- Webinar promotion for regulatory education

- Product launch announcements to specific segments

- Long-term nurture campaigns for 6-18 month sales cycles

Segmentation Strategies for Maximum Impact

By Institution Type

Commercial banks value stability and proven solutions. Investment firms want speed and competitive advantage. Credit unions are budget-conscious and member-focused. Fintech companies crave innovation and modern tech stacks. Insurance providers prioritize compliance and data integration.

Your finance and banking email list should enable this granular targeting.

By Job Role

C-suite executives care about strategic ROI, and board-level metrics keep it high-level. Compliance teams need to know you’ll reduce audit findings and regulatory headaches. Finance leaders want cost savings and efficiency. IT teams evaluate integration capabilities, security certifications, and vendor reliability.

Send the same email to all? You’ll fail with all.

By Company Size

A $500 million regional bank and a $500 billion multinational operate in different universes. Segment by asset size (under $1B, $1B-$10B, $10B+), employee count, and growth stage. Smaller institutions need turnkey solutions; larger ones have bigger budgets but require extensive proof-of-concept.

Email Best Practices That Actually Work

Personalization Is Non-Negotiable

“Dear Finance Professional” gets deleted instantly. Instead:

- Reference specific initiatives: “Noticed [Bank Name] launched mobile lending…”

- Use role-based pain points: “Community banks lost $2.3B to synthetic identity fraud…”

- Cite relevant proof: “We helped 47 regional banks deploy AI verification…”

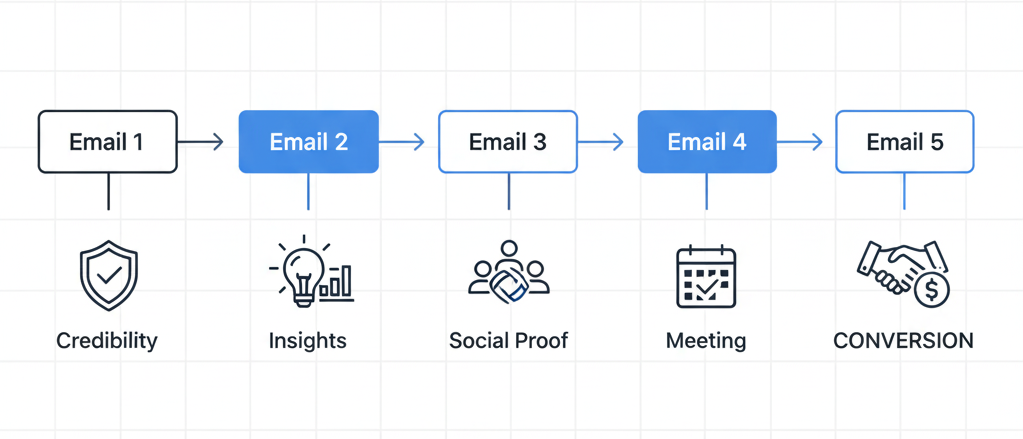

Build Multi-Touch Sequences

One email and done? That’s like proposing on the first date. Build a 5-email sequence over 2-3 weeks:

- Day 0: Establish credibility with a trigger event

- Day 4: Share valuable insights, no ask

- Day 8: Provide social proof from similar institutions

- Day 14: Make a clear, low-friction ask

- Day 21: Breakup email (often highest response rate)

80% of sales require 5+ touchpoints, but 44% of salespeople quit after one follow-up.

Align Email with Landing Pages

If your email promises “5 fraud reduction strategies,” deliver exactly that on the landing page. Use industry-specific case studies, echo the same language, and make the CTA crystal clear. One fintech company increased conversions 67% by creating segment-specific landing pages instead of sending everyone to a generic homepage.

Compliance: Non-Negotiable Foundations

When using a banking and finance email list, compliance with GDPR, CAN-SPAM, and financial data standards is critical.

Key Regulations

GDPR: Required if emailing anyone in the EU. Violations cost up to €20 million or 4% of global revenue. CAN-SPAM: Requires accurate sender info, honest subject lines, and clear opt-outs. Each violation: $46,517. CCPA: California and other state laws may apply to banking contracts.

Compliance Best Practices

- Include one-click opt-out in every email

- Use honest sender identity (no fake names)

- Partner with reputable data providers who verify consent

- Document your sourcing and compliance processes

- Honor unsubscribe requests within 10 days

- Respect role changes and job transitions

Banks talk to each other. Get flagged for non-compliance, and you’re blacklisted industry-wide.

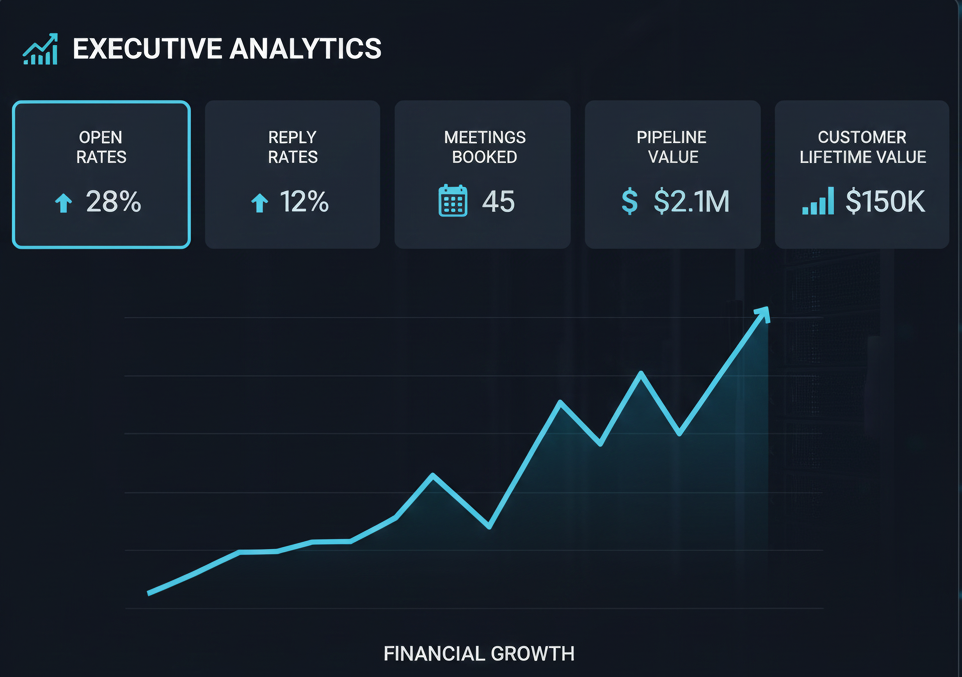

Measuring ROI from Your Banking Email List

Core Metrics

- Open rate: 20-25% is average; above 30% means strong targeting

- Reply rate: 5-10% for cold outreach; 15-25% for warm leads

- Conversion rate: Meetings booked per email sent

- Cost per lead: Should be under $100 for quality banking leads

- Customer lifetime value: One client might stay 5-10 years, judge accordingly

- Pipeline generated: Track revenue potential, not just closed deals

Attribution Intelligence

Track by segment: Which institution types convert best? Which roles engage most? Compare email performance against LinkedIn ads, Google Ads, and trade shows. Measure pipeline influence,e sometimes an email warms an account that converts six months later.

A 2% improvement in reply rate across 10,000 contacts means 200 additional conversations and potentially millions in the pipeline.

Critical Mistakes to Avoid

- Generic emails: Mail merge tone = instant delete

- Ignoring compliance: One violation can cost $50,000+ and your reputation

- Targeting too broadly: Not everyone in finance needs your product

- Outdated data: Bounced emails destroy the sender’s reputation

- Volume over quality: 100 targeted contacts beat 10,000 random names

- Giving up too early: Banking sales cycles are long; persistence wins

- Mobile neglect: 67% check email on mobile; optimize or lose them

Choosing a Quality Email List Provider

What to Demand

- 95%+ accuracy guarantee with replacement policy

- Deep segmentation: 15+ filter criteria (asset size, job function, tech stack)

- Compliance transparency: Clear sourcing documentation

- Monthly or quarterly updates (data decays at 22.5% annually)

- Industry specialization: Banking-focused vendors have better data

- Sample data: Test 50-100 contacts before buying

- Integration support: Compatible with your CRM and tools

Red Flags

- No opt-out policy or replacement guarantee

- Unrealistically cheap pricing (quality lists: $0.10-$0.50 per contact)

- No sample data available

- Poor reviews on G2 or Trustpilot

- Vague sourcing methodology

- Pressure tactics and “limited time” offers

Are banking email lists legal?

Yes, when sourced and used properly with CAN-SPAM and GDPR compliance. Business contact information for B2B purposes is generally permissible.

Monthly for continuous campaigns, quarterly minimum. Financial professionals change jobs every 18-24 months on average.

Absolutely. Cold email works in financial services when personalized, compliant, and value-focused.

Fintech, cybersecurity, compliance software, data analytics, consulting, and any B2B company selling to financial institutions.

Personalize by role and institution type. Use specific subject lines. Provide value upfront. Follow up 5-7 times over 2-3 weeks. Make it about them, not you.